Federal Benefit Managers are HR professionals, retirement counselors, agency benefits officers and people managers who help federal employees navigate their benefits. AFBA supports their employees with benefit training and personalized benefit consultations.

Pre-retirement planning and financial literacy training for federal employees

For over 75 years, Armed Forces Benefit Association (AFBA) has provided benefits to those who serve, defend, and protect our nation. Today, AFBA continues its non-profit mission of support by addressing the core concerns of federal employees through pre-retirement benefits and financial literacy training. This training is crucial for federal employees to understand their retirement income, and other benefits necessary, to meet their financial and health needs as they transition through and from government service. Congress recognized this training need by passing United States Code Title 5 §8350, providing a foundation for federal employees to understand and manage their benefits. The result is a workforce with greater financial security that can focus on their important work of serving fellow Americans.

AFBA differentiators

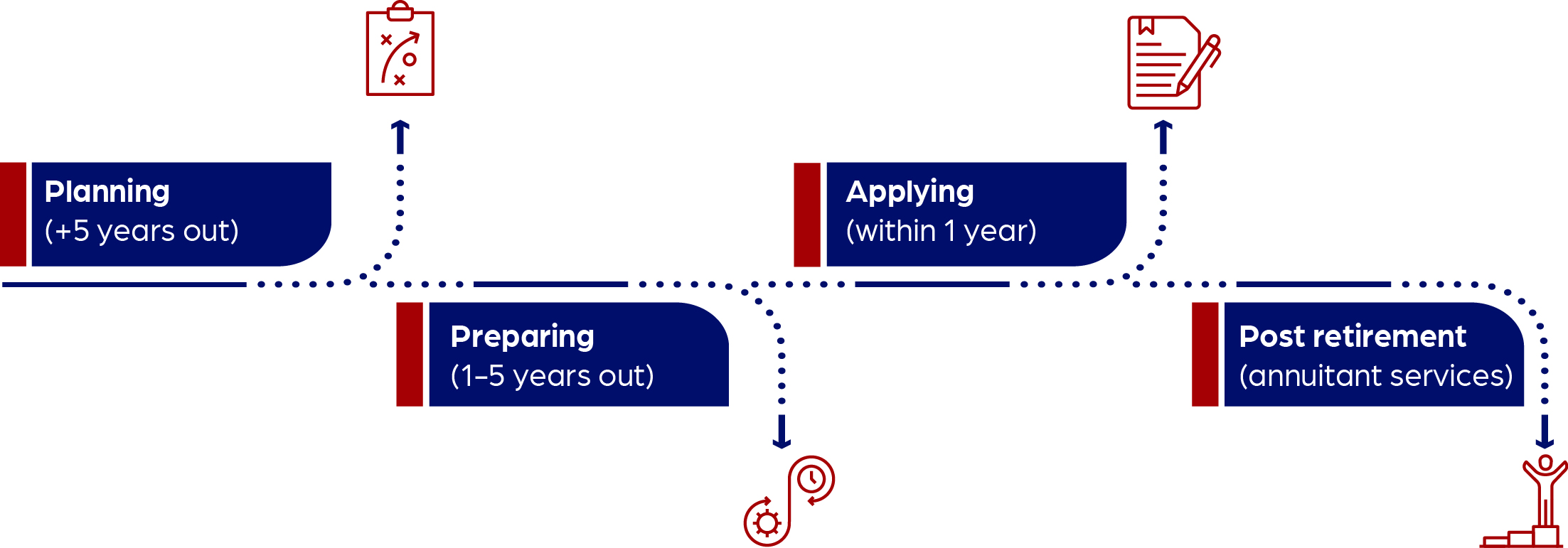

AFBA’s retirement and financial literacy training delivers for employees at all career stages – early-career, mid-career, and pre-retirement. The AFBA model integrates information on federal benefits programs with a comprehensive approach to retirement planning. This strategy broadens the focus of pre-retirement education in federal agencies, considering retirement financial literacy and education as a career-long process. It incorporates the broad range of information employees need to make informed retirement planning decisions, recognizing that these needs evolve throughout their careers.

Benefit training catalog

CSRS/FERS/BRS

Retirement eligibility and annuity calculations.

Thrift Savings Plan

Pre and post-retirement planning.

Survivor annuity

Options and alternative plans.

Social security benefits

Factors to consider for retirement planning.

Federal employees health benefits

FEHB, TRICARE and Medicare options.

Federal Employee Life Insurance

FEGLI, SGLI, and VGLI evaluation.

Prior military service buy-back

Eligible time that may count towards retirement.

Core competencies

In alignment with the OPM mandates, Title 5, Section 8350 of the U.S. Code, AFBA provides comprehensive benefits training.* Each standard training session is one (1) hour in duration and spouses can be included. Each session is suitable for early-career, mid-career, and pre-retirement employees, as well as special provision employees (Law Enforcement Officers, Firefighters, Air Traffic Controllers, and Dual-Status Military Reservists and

Dual-Status National Guard Technicians).

The training is a supplement to any financial literacy and pre-retirement training currently provided by the government, and respective agencies. The training provides an overview for employees of their benefits and what they can do now to plan for their retirement and financial security. Most importantly, employees are enabled to pursue an individual benefit consultation, allowing for well-calculated decisions based on their unique circumstances, goals, wants, and needs.

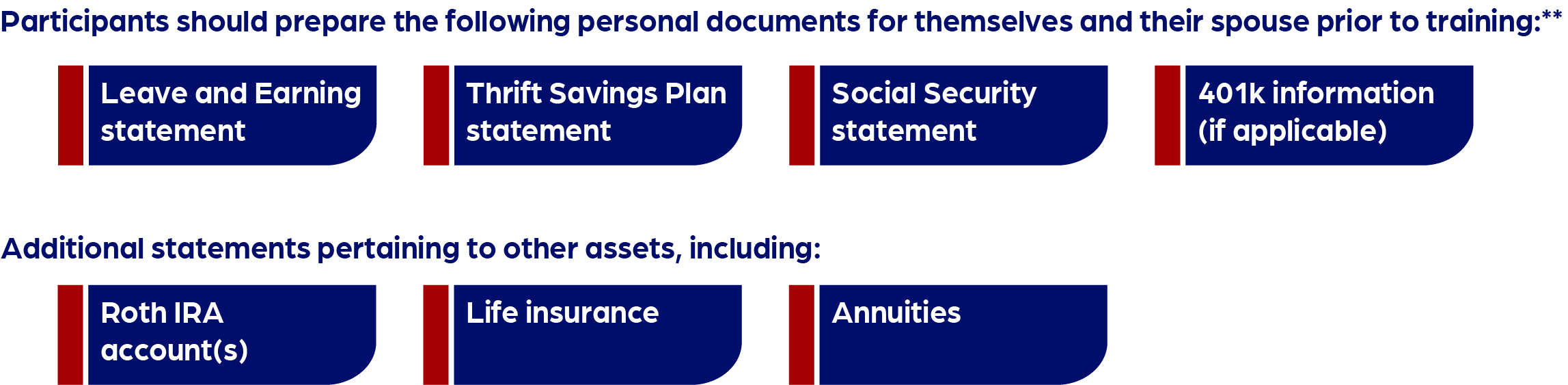

After face-to-face or video training, interested participants are scheduled to receive a complimentary one-on-one benefits consultation. In this meeting the necessary information is gathered to allow for personalized retirement projections and an individualized benefit analysis to be generated.

* Note: There will be no offer to sell participants any products during the training. No other follow-on one-on-one sessions will be provided to participants under the auspice of a specific Performance Work Statement or Statement of Work (SOW).

**Note: No other follow-on one-on-one sessions will be provided to participants under the auspice of a specific Performance Work Statement or Statement of Work (SOW).

Qualified instructors

AFBA instructors are U.S. citizens with comprehensive knowledge of CSRS, FERS, BRS, health benefits, life insurance, and TSP. They hold credentials such as Federal Retirement ConsultantSM (FRCSM), Chartered Federal Employee Benefits ConsultantSM (ChFEBCSM), and Certified Military Financial Advisor® (CMFA®). QIs adhere to all professional rules and regulations, they are subject to set forth by state and federal law, licensing boards, state agencies, companies, and industry organizations.

Past performance

Training has been delivered to various agency employees by our Qualified Instructor partners.

| DeCA | DoD | DOI | DOJ | DOL | EPA | FAA |

| GSA | SSA | TSA | USDA | USPS | VA |

Place of performance and furnished training items

In person, or via live video within the Continental United States (CONUS), or via live video (in person with award) when Outside the Continental United States (OCONUS). The trainers provide student training guides, handouts, and any necessary presentation materials.

After training deliverables

Upon completion of each training course a certificate of completion will be provided to each trainee, and the following documents will be provided to the Agency POC:

- Completed roster including training name, date, and students’ full names.

- Completed student end-of-course evaluations.

Request training

Pre-retirement planning and financial literacy training for federal employees.

Complete formFrequently Asked Questions

What services does AFBA provide to federal employees?

AFBA offers comprehensive pre-retirement planning and financial literacy training tailored to federal employees at all career stages. This includes education on CSRS/FERS retirement systems, Thrift Savings Plan (TSP), FEGLI, Social Security, and more.

Is AFBA affiliated with a federal government?

No. AFBA is a non-profit association and is not affiliated with, endorsed by, or sponsored by any U.S. federal government agency. It operates independently to support federal employees through education and benefit awareness.

Who can attend AFBA’s training sessions?

Training sessions are open to early-career, mid-career, and pre-retirement federal employees, including special provision employees such as Law Enforcement Officers, Firefighters, Air Traffic Controllers, and Dual-Status Military Reservists. Spouses are also welcome to attend.

What topics are covered in AFBA’s benefit training sessions?

Topics include:

- CSRS/FERS retirement eligibility and annuity calculations

- Thrift Savings Plan (TSP) strategies

- Survivor annuity options

- Social Security integration

- FEHB, and Medicare coordination

- FEGLI evaluations

- Military service buy-back options

How long are the training sessions?

Most standard training sessions are one hour in duration and designed to be engaging, informative, and actionable.

Can employees receive personalized retirement planning support?

Yes. After attending a session, employees are encouraged to pursue individual benefit consultations. These sessions are tailored to your unique career path, goals, and financial needs.

How does AFBA’s training align with federal mandates?

AFBA’s training aligns with Title 5, Section 8350 of the U.S. Code, which mandates retirement and financial literacy education for federal employees. The training supplements existing agency programs. For more information, click here.

Is there a cost to attend AFBA’s training or consultations?

No. AFBA provides these services as part of its non-profit mission to support those who serve. There is no cost to the federal employee for attending sessions or receiving consultations.

How do I schedule a training session or consultation?

You can schedule a session by completing the form on this page.

What is the responsibility of agency benefit officers?

Agency benefits officers have the primary responsibility to provide retirement financial education to their employees.

What is responsibility of the employee?

Employees must attend the financial education workshops, fairs, etc., that are conducted by their agencies. They must make a commitment to learn and take the actions needed, in order to achieve their retirement goals.¹

¹U.S. Office of Personnel Management. (2005). Retirement financial literacy and education strategy: Report to the Congress. www.opm.gov/about-us/reports-publications/2005-retirement-financial-literacy-and-education-strategy.pdf

AFBA is not affiliated with, endorsed by, or sponsored by any U.S. Federal Government Agency.